Do you or members of your family have unclaimed property that is sitting in the hands of the state? With statistics from the National Association of Unclaimed Property Administrators estimating that nearly $42 billion dollars in unclaimed property exists nationally, there may be a chance that someone in your family just might have assets waiting to be claimed.

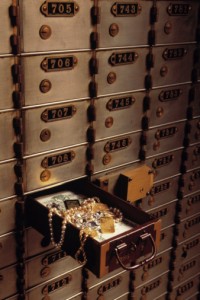

From stock dividends and certificates to life insurance policies and pension benefits, there is no shortage of assets that end up parked with the state each year for safekeeping.

So why do assets end up in the hands of the state? When financial institutions cannot locate the legal owner of the property they are holding, state law requires that they transfer or escheat these assets to the state until the owner or an heir can come forward to claim the property. (Escheating is the term to describe how property is reverted to the state when no legal heirs or claimants exist and can occur after three to seven years depending on the state.)

According to The Unclaimed Property Administration of NJ, the UPA recovers and records abandoned or lost intangible and tangible property with the goal to return this property to the rightful owner and/or heirs. NJ Unclaimed Property Statute states that property owners never relinquish the right to this property and that the UPA acts as a custodian until the property is returned.

Since the rightful owners or their heirs may be completely unaware that unclaimed property exists, these assets often pile up with the state and go unclaimed for years to come. In fact, according to the NAUPA, only 5-percent of total outstanding unclaimed property is claimed each year.

How to check if you have unclaimed property

The first step in the process is to determine if unclaimed property exists for you or a family member. While the good news is there are online resources to visit to research this, the bad news is that you may have to visit multiple sites depending on the type of property you are researching. Consider visiting the NAUPA site, www.unclaimed.org and www.missingmoney.com for general information about the process and links to each state's unclaimed property site to begin your search.

With nearly $2.5 billion of life insurance policies going unclaimed each year, be sure to carefully examine these assets. Why might insurance policies go unclaimed? First, there is really no way for an insurance company to know that someone passed away unless a beneficiary notifies them of the death. If there are no known beneficiaries or the beneficiaries are unaware that the policy even exists, insurance proceeds may go unclaimed for years. To search for insurance proceeds or demutualization proceeds consider visiting www.demutualization-claims.com

Next, consider checking for pension benefits. According to the Pension Benefit Guarantee Corporation, nearly $300 million of unclaimed pension benefits exist today. Consider visiting www.pbgc.gov for more information and to run a search.

Finally, consider checking with the Internal Revenue Service. Surprisingly, each year, both unclaimed refunds and undeliverable refunds occur.

According to the IRS, some people earn income and may have taxes withheld from their wages but are not required to file a tax return because they have too little income. In this case, you can claim a refund for the tax that was withheld from your pay.

Other workers may not have had any tax withheld but would be eligible for the refundable Earned Income Tax Credit, but must file a return to claim it. To collect unclaimed refunds, a return must be filed with the IRS no later than three years from the due date of the return.

Keep in mind, if no return is filed to claim the refund within three years, the money becomes the property of the U.S. Treasury.

On the other hand, some taxpayers file a return and never receive their refund check. Since refund checks are mailed to your last known address, they are often returned to the IRS if you move without notifying the IRS or the U.S. Postal Service. Consider visiting www.irs.gov/refunds to check on the status of your refund.

Heir finder services

While searching, locating and filing a claim for property might not be too difficult for some, others may want assistance in handling the process. While there are plenty of companies out there that can help with searching and filing a claim, they may charge as much as 50-percent of the unclaimed property's value to assist you.

Additionally, there have been scams so be extra careful and do your homework before enlisting the help of these "heir finder" services.

Preventing unclaimed property

The good news is that unclaimed property may be preventable. First, be sure that you notify all financial institutions, utilities and companies you do business with address and name changes. Next, work with an attorney to prepare a complete estate plan including a will and power of attorney. Consider coordinating beneficiary designations with your estate plan and be sure that organized financial records are maintained for executors and beneficiaries.

Remember, passing away without a will or named beneficiaries can lead to property going unclaimed as there is no mechanism to connect beneficiaries with the property.

It may also be a good idea for adult children to have an open discussion and thorough review of estate planning documents with their senior parents. While proper planning and good record keeping can help, consider speaking to your legal and financial advisers to discuss the appropriate approach for you. It may just help prevent your assets from joining the billions in assets waiting to be claimed by their rightful owner.

Kurt J. Rossi, MBA is a Certified Financial Planner Practitioner & Wealth Advisor. He can be reached for questions at 732-280-7550, kurt.rossi@Independentwm.com, www.Independentwm.com - LPL Financial Member FINRA/SIPC.