Americans continue to rely on debt to finance many of their consumer purchases. In fact, according to the Federal Reserve, total U.S. outstanding consumer debt is nearly $3.62 trillion. Because of this reliance on debt, establishing a strong credit history and score may end up saving you thousands of dollars in reduced interest charges over your lifetime. While most people understand the importance of their FICO score, many struggle to maintain the top scores necessary to ensure they have access to attractive financing options. From legitimate financial emergencies to poor spending habits, there are many obstacles that may get in the way of maximizing your credit score.

Americans continue to rely on debt to finance many of their consumer purchases. In fact, according to the Federal Reserve, total U.S. outstanding consumer debt is nearly $3.62 trillion. Because of this reliance on debt, establishing a strong credit history and score may end up saving you thousands of dollars in reduced interest charges over your lifetime. While most people understand the importance of their FICO score, many struggle to maintain the top scores necessary to ensure they have access to attractive financing options. From legitimate financial emergencies to poor spending habits, there are many obstacles that may get in the way of maximizing your credit score.

While it may be easier said than done, boosting your credit rating may be possible through a disciplined, systematic approach over time. Using the steps below may help jump start your progress.

- Request your report and score: Examining your report and score at least annually can ensure the accuracy of your report while providing clarity on your current scores. Pay special attention to any inaccurate late accounts or charges. Consider visiting sites such as myfico.com or creditcarma.com to request your free report and score. Be wary of subscriptions to credit monitoring services as they may not be necessary if you stay on top of your scores yourself.

- Dispute errors: Be sure to contact the 3 credit reporting bureaus TransUnion, Experian & Equifax to correct any errors in your report. Disputes can usually be initiated online and the removal of incorrect credit errors may significantly improve your score.

- Request a goodwill adjustment: Late payments do happen - often due to emergencies or other circumstances. Writing a goodwill letter to the bank outlining your situation and requesting that a late payment be removed from your report can work – especially if your account is now current. If you are still behind on payments, you may consider negotiating the removal of blemishes on your credit report in exchange for paying an account in full. Be sure to get their commitment to this in writing. Bottom line – the Fair Credit Reporting Act does not demand that all accounts be reported, just that they are reported accurately. Financial institutions have some discretion.

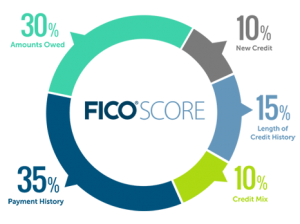

- Improve payment history: Getting current and staying current with your liabilities is critical as 35% of your FICO score is based upon these factors. Remember, more recent credit history is weighted more heavily than older data so establishing a positive payment history will slowly help improve your score. Consider signing up to receive payment reminders from your financial institution to ensure that you are always aware of upcoming due dates and avoid late payments in the future.

- Reduce your credit utilization rate: 30% of your FICO score is based upon how much of your available credit is being used. For example, if you have a card with a $10,000 limit but have a balance of $8,000, you are utilizing 80% of your available credit. Keeping your utilization rate below 30% may help boost your score. For a more significant boost – consider keeping your utilization rate below 10% if possible.

- Make multiple payments each month: A simple, yet effective approach to improving your credit utilization is to make payments more frequently – especially if you are near maxing out your available credit. This can help even if you are paying the same total amount each month. Reducing your balances will reduce your utilization rate and can help with your scores. This may also reduce the likely hood of additional interest charges and late payments.

- Raise your credit limit: While you cannot solve a debt problem with more debt, contacting your creditor to request that they increase your limit can help reduce your utilization rate and improve your score. However, be careful not to use this as a “green light” to spend more.

- Be careful when closing cards: Closing credit cards can result in a drop in your score as your available credit declines. However, there is no reason to have credit established with every major retailer. Instead, do your best to limit the number of credit cards to two or three cards that offer attractive rates. If you are having difficulty establishing credit, consider a secured card that limits your available credit to the amount you have deposited with the financial institution.

- Limit the number of new accounts: Opening new accounts too rapidly can reduce the “age” of your accounts, resulting in a lower score. This is especially true if you are just beginning to build your credit history so be sure to avoid going on a credit opening spree.

- Reduce your reliance on debt: The convenience of credit cards and our “one click purchase” economy can be very dangerous for consumers. Carefully budgeting your expenses each month in conjunction with a switch to cash may help accelerate the process of paying down your debt. Remember, it can be exponentially harder to pay down debt as you keep piling new debt on top.

Improving your credit score may difficult to accomplish overnight and in some cases, consulting with debt consolidation specialists may be necessary. A disciplined approach to reducing debt and increasing your credit score may help over the long term. Since everyone’s situation is unique, consider speaking to your attorney and financial advisor to determine the most appropriate approach for you.

Kurt J. Rossi, MBA, CFP®, CRPC®, AIF® is a CERTIFIED FINANCIAL PLANNERtm Practitioner & Wealth Advisor. He can be reached for questions at 732-280-7550, kurt.rossi@Independentwm.com, www.bringyourfinancestolife.com & www.Independentwm.com. LPL Financial Member FINRA/SIPC.