Running out of money in retirement continues to be a major concern for many Americans. In fact, a recent report from the Economic Policy Institute notes that 60 percent of baby boomers are more concerned about running out of money than they are about passing away. Squirreling away enough money to maintain your lifestyle, fund travel experiences, address liabilities and account for financial curve balls like health care costs is not easy. Fear and uncertainty regarding whether you “have enough” often leads to stress and anxiety in retirement.

Running out of money in retirement continues to be a major concern for many Americans. In fact, a recent report from the Economic Policy Institute notes that 60 percent of baby boomers are more concerned about running out of money than they are about passing away. Squirreling away enough money to maintain your lifestyle, fund travel experiences, address liabilities and account for financial curve balls like health care costs is not easy. Fear and uncertainty regarding whether you “have enough” often leads to stress and anxiety in retirement.

Despite the importance of developing a financial plan, most Americans never actually do it. According to previous statistics from the Certified Financial Planner Board of Standards, only 31 percent of Americans have developed a financial plan that includes retirement, tax, estate and emergency funds. Remember, an investment plan is not a financial plan and many investment professionals begin by asking what you have to invest rather than what do you want to accomplish in your life. The fact is there is no way to know how to invest without knowing what you need your funds to do. Money is simply a tool that can enable you to focus on the things that are most important in your life.

Review a multi-scenario plan

One of the common difficulties with financial life planning is that life is always changing and the future is uncertain. While this may be true, running multiple scenarios that simulate real life can help. For example, consider determining the maximum amount you can spend under varying retirement dates, travel expenses, business sale amounts, gifting scenarios, 2nd home purchases, health care or assisted living expenses and life expectancies. Virtually any scenario can be modeled to provide clarity on the impact of decisions before they are made. Reviewing multiple scenarios may also help identify financial constraints before you choose an unsustainable path for the future. Wouldn’t it be nice to know that you are on a path that would increase the chances of running out of money before you choose it?

Right-size your house

Spending a disproportionately large amount of income and assets on housing is a common issue for many Americans – especially in high priced areas of the country like New York, New Jersey, California, Hawaii, Connecticut and Massachusetts where housing affordability is lowest. While leaving a state due to housing costs is not always feasible, choosing a more affordable home can be an option. Some Americans are spending as much as 40 – 50 percent of their income on housing alone - leaving little income for travel or other discretionary expenses. Rather than view a change in housing as a downsize, think of it more as a “right-sizing” your housing. Too often retirees feel forced to downsize and resist it only to realize later that they have significantly less financial stress and more discretionary income to apply toward other areas. Determining the right housing plan is critical when trying to stay on track in retirement.

Cut out waste and eliminate debt

Regardless of income or asset levels, financial waste is common for most Americans. From depreciating asset purchases like automobiles to utilities and subscription services, there are plenty of opportunities to cut financial waste. First, examine your financial priorities and consider eliminating expenses that simply are not important to you. For priority expenses, consider renegotiating and searching for alternatives. Surprisingly, many retirees spend time and money on things that are simply not that important to them. Budgeting is key to identifying these areas.

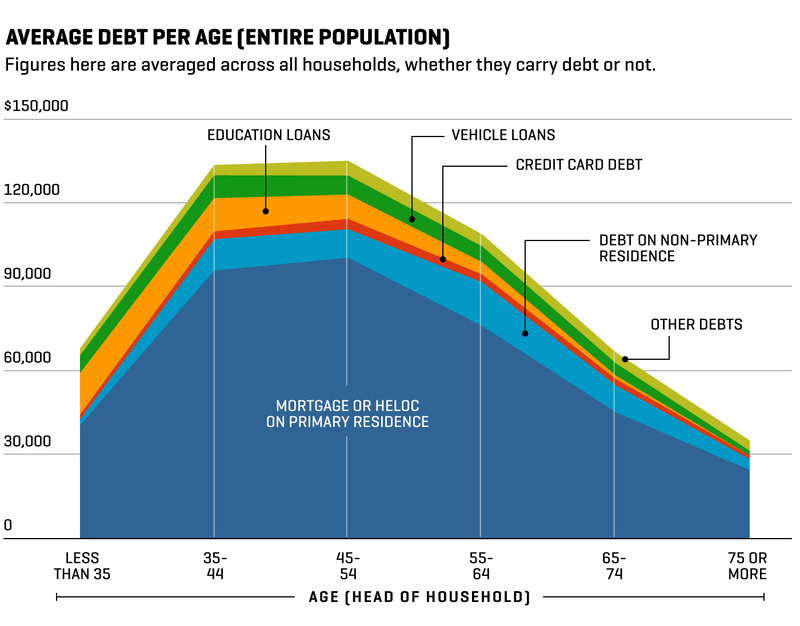

For many Americans, the probability of running out of money is also directly related to levels of debt. Unfortunately, more and more retirees are bringing the burden of debt with them into retirement. According the Federal Reserve’s Survey of Consumer Finances, average debt levels for pre-retirees between the ages of 55-64 is $108,000 while retirees between the ages of 65-74 is $66,000. Eliminating debt prior to retirement may help improve the sustainability of your retirement lifestyle.

SOURCE: Federal Reserve's 2016 Survey of Consumer Finances; custom data set pulled for MONEY. NOTE: Other debts may includes home improvement or medical debt, non-HELOC lines of credit, loans against retirement accounts or insurance policies, among others.

Don’t forget to plan for the worst

Let’s face it, financial curve balls are constantly being thrown and many Americans are not necessarily prepared to address them. Consider reviewing the impact of various worst-case scenarios including a bear market or recession, one spouse living shorter or longer than expected, nursing and health care costs and unforeseen maintenance and repairs. Financial support for aging parents and adult children may also need to be considered too. Having a game-plan for worst-case scenarios may help retirees to course-correct and get back on track when life takes them on a detour.

Making a transition from a life with financial worry to a life of financial confidence and contentment requires careful planning. Reviewing multiple what-if scenarios for the future, right-sizing your housing expense, eliminating financial waste and reducing debt are all important first steps to take. Since everyone’s situation is unique, consider speaking to your tax and financial advisers to determine the most appropriate financial planning approach for you.

Kurt J. Rossi, MBA, CFP®, CRPC®, AIF® is a CERTIFIED FINANCIAL PLANNERtm Practitioner & Wealth Advisor. He can be reached for questions at 732-280-7550, kurt.rossi@Independentwm.com, www.bringyourfinancestolife.com & www.Independentwm.com. LPL Financial Member FINRA/SIPC.