The economic impacts of COVID-19 continue to reverberate through the economy as more and more workers and businesses struggle with the financial impacts. While many economists expect workers to gradually return to their jobs over the coming months, a large percentage of Americans will likely end the year with reduced income for 2020. From furloughs and layoffs to wage cuts and reduced hours, lower wages have created difficulties for many individuals and families. While reductions in income are usually not welcomed, there may be some financial planning approaches to consider.

Leverage a Roth

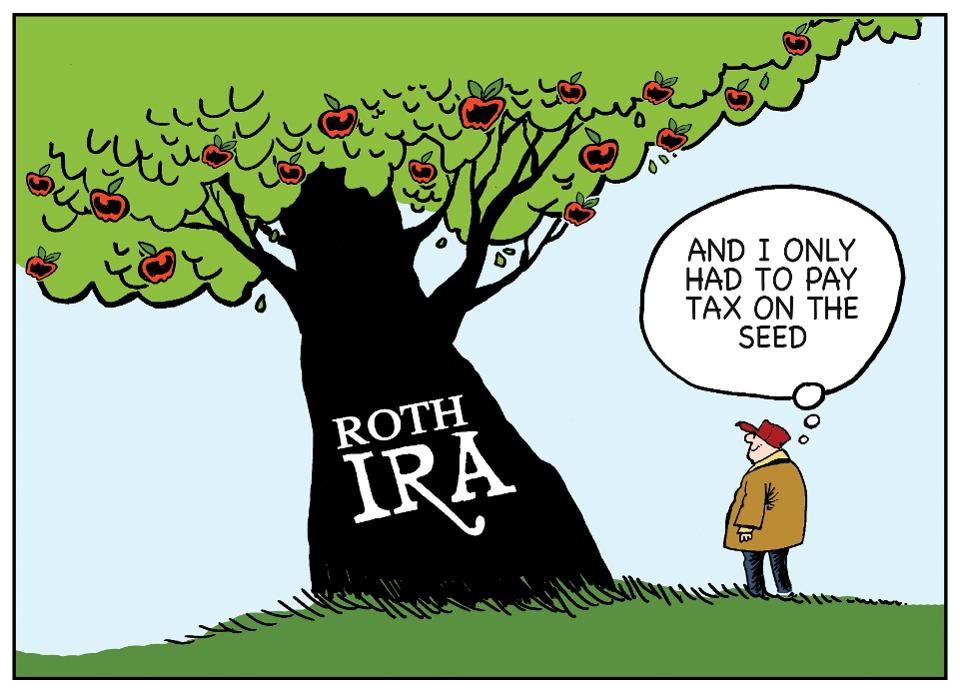

A Roth IRA allows taxpayers to earmark after-tax savings that may grow tax-free. On the other hand, distributions from a Traditional IRA are fully taxable. For many taxpayers, it can be beneficial to diversify both their investments and the tax treatment of their distributions from investments, making the Roth a helpful tax planning tool. And with record levels of government  spending aimed at supporting the economy, the chance that taxes increase in the future may be rising, possibly increasing the attractiveness of the Roth IRA for years to come.

spending aimed at supporting the economy, the chance that taxes increase in the future may be rising, possibly increasing the attractiveness of the Roth IRA for years to come.

While the Roth IRA has always been an important tool for retirement savers, contribution limits often prevent taxpayers from taking advantage. For those that might not have otherwise qualified, lower income levels may open the door for Roth contributions. For single filers in 2020, full Roth contributions are available up to $124,000 in income with phaseouts occurring if you earn between $124,000 and $139,000. For Taxpayers married filing jointly, full contributions are available up to $196,000 in income with contributions phasing out from $196,000 to $206,000.

While it can be difficult to save money when your income has also declined, taxpayers that are still in the position to save may want to implement a Roth in 2020.

For taxpayers that may not qualify for a Roth IRA but still want to hedge the risk of higher future tax rates, a Roth 401(k), which has no income limitation may be a good opportunity. However, be sure to review your marginal tax rate with a professional to determine whether a Roth or Traditional 401(k) would be more advantageous for you.

In addition to reductions in income, some taxpayers have also experienced declines in the value of their portfolios, which offers some additional planning opportunities. First, taxpayers that may find themselves in a lower tax bracket this year may want to take the Roth strategy one step further and consider a Roth conversion.

Converting a traditional IRA to a Roth IRA while you are in a lower marginal bracket may be beneficial for some taxpayers. Specifically, a Roth may be especially attractive if you believe that you might be in a higher tax bracket in retirement than you are today. Implementing a Roth conversion while your account balance is lower due to market volatility can also make this strategy even more beneficial. However, Roth IRA conversions can be a little complicated and it is important to understand the full impact.

Since a Roth conversion will usually result in having to pay a tax bill due to the conversion, it is also important that you have the cash reserve to pay the tax liability. You also should familiarize yourself with the five-year rule for withdrawals from a Roth which requires that you hold your account for five years prior to distributing earnings. Remember, this only applies to earnings and not your principal. Lower marginal tax rates can make the Roth conversion more attractive so be sure to examine the numbers with a professional.

While most investors do not want to experience declines, volatility can also open the door to strategic tax-loss and tax-gain harvesting opportunities. While most investors are aware of harvesting losses while the market may be down, some investors may forget about harvesting gains too.

If you have investments that you may have wanted to sell and diversify in the past but held off doing so because of the taxable gains, now may be a more attractive time to harvest the gains. First, the capital gain may be lower if the value of the security is lower. Second, if your income is down this year, you might even be able to harvest the gain at a 0% long term capital gains rate. This would apply for single filers with income from $0 to $40,000 and married filers filing jointly with income from $0 - $80,000. Both single filers with income from $40,000 to $441,450 and married joint filers with income from $80,000 - $496,050 pay long term capital gains at a rate of 15% while taxpayers above those thresholds pay at the 20 percent rate. Keep in mind, there is also a net investment income tax of 3.8 percent which applies to any income that came from investments in excess of $200,000 for single filers and $250,000 for married filers.

Prior to implementing any savings or investing plan, be sure to maintain sufficient cash reserves and or lines of credit to help with liquidity needs. Since everyone’s situation is unique, consider speaking to your tax and financial advisers to determine the most appropriate approach for you.

Kurt J. Rossi, MBA, CFP®, CRPC®, AIF® is a CERTIFIED FINANCIAL PLANNERtm & Wealth Advisor. He can be reached for questions at 732-280-7550, kurt.rossi@Independentwm.com, www.bringyourfinancestolife.com & www.Independentwm.com. LPL Financial Member FINRA/SIPC.