The economic impacts from the COVID-19 Pandemic have been steeper than initially anticipated. According to the National Bureau of Economic Research (NBER), we officially entered a recession back in February of this year and increases in unemployment, declines in retail sales, and downward revisions in GDP projections has forced many economists to revise projections for both the depth of the decline as well as the track of an anticipated recovery.

The economic impacts from the COVID-19 Pandemic have been steeper than initially anticipated. According to the National Bureau of Economic Research (NBER), we officially entered a recession back in February of this year and increases in unemployment, declines in retail sales, and downward revisions in GDP projections has forced many economists to revise projections for both the depth of the decline as well as the track of an anticipated recovery.

However, unlike previous recessions, our future is dependent on the long-term impact of the coronavirus, something very difficult to predict. While some parts of the country such as New Jersey and New York have recently experienced declines in the number of new cases, others have experienced a significant surge, further complicating the projections for a possible recovery.

While no one has a crystal ball to help predict the future, being aware of the possible economic paths can be helpful when assessing your individual financial plan, goals, time frame and investment objectives.

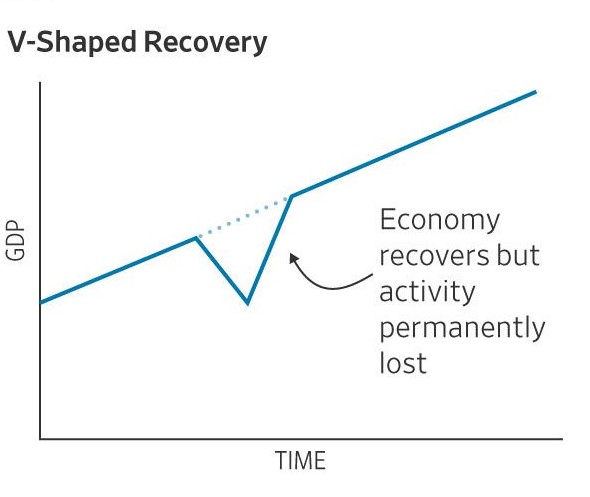

In a typical “V” shaped recovery, the economy experiences a steep economic decline followed by a quick rebound or recovery. These types of recessions are usually short-term in nature and often regarded as a best-case scenario when describing economic downturns. The recession of 1920 and 1953 are both regarded as being “V” shaped.

While many economists initially expected a “V” shaped recovery, the duration of the first wave of COVID cases has led some to reassess their projection for a quick, sustainable rebound for our economy. However, others are sticking to their initial projection. In fact, Morgan Stanley chief economist Chetan Ahya has doubled down on this prediction, citing that macro indicators point toward the recovery having begun in May with momentum picking up in June.

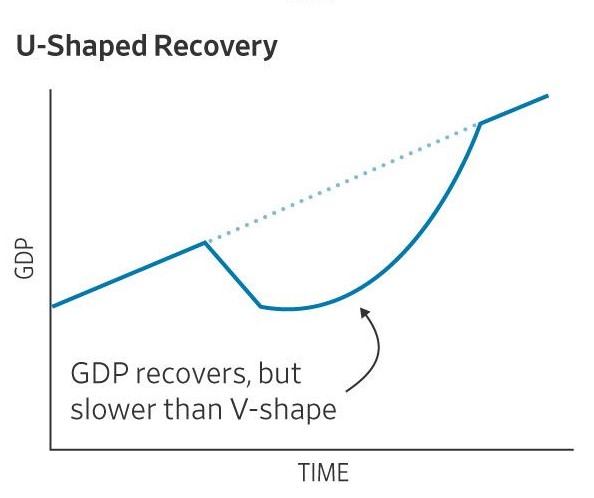

A steep economic decline followed by a delayed, but steep recovery is often the best way to describe a “U” shaped recovery. This normally occurs when the economy falls and then struggles to jump start back up. Simon Johnson, the former chief economist for the International Monetary Fund, says a U-shaped recession is like a bathtub, "You go in. You stay in. The sides are slippery. You know, maybe there's some bumpy stuff in the bottom, but you don't come out of the bathtub for a long time." The recessions of 1973 and 1990 are both examples of “U” shaped recoveries as both hoovered at lower levels before eventually bouncing back.

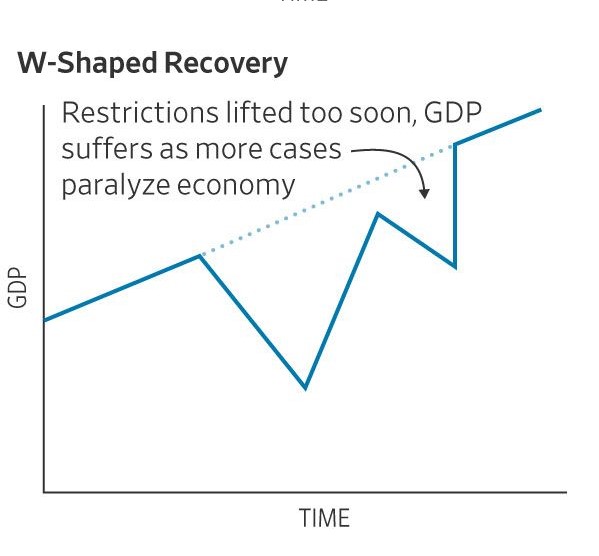

An economy that declines, rapidly begins to recovery and then experiences another decline is the mark of “W” shaped recovery. These “double dip” recessions are particularly difficult. Expectations for a “V” shaped recovery can turn to a “W” shape fairly quickly, catching some off guard. The 1980 recession that occurred from January – June was followed up by another recession in 1981 that lasted until 1982.

Some economists fear a second wave of COVID-19 cases could pull the economy backward again, leading to a “W”. According to Robert Johnson, professor of Finance at Creighton University, “Americans may end social distancing prematurely and a secondary outbreak of the coronavirus could force another round of social distancing, stalling the recovery,”.

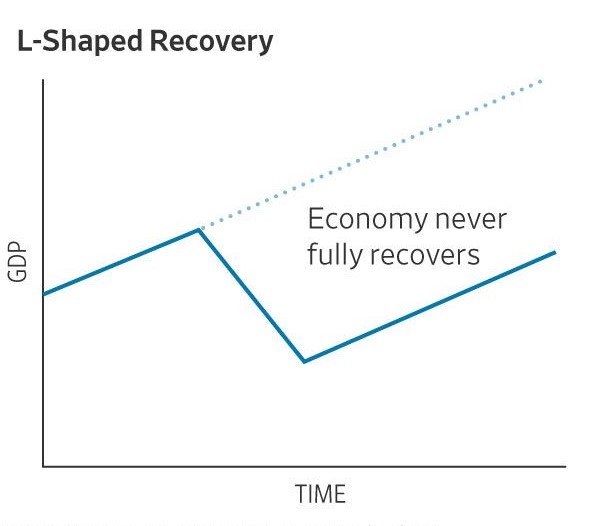

When the economy experiences a steep decline followed by a long period of stagnation and a very slow recovery, we are describing an “L” shaped recovery. Unlike the “U”, an “L” often has a much longer period of stagnation and a much slower recovery.

The Great Depression of 1930, the lost decade in Japan and the Great Recession in 2008 are often regarded as “L” shaped recoveries. In all of the above cases, it took many years for unemployment to get back to pre-recession levels. While many economists do not believe we will follow this path, a prolonged shutdown due to an inability to contain the virus is something economists are watching very carefully.

Billionaire investor and philanthropist George Soros may have been the first to use this term to describe an economic recovery. In this case, the economy experiences a steep decline, followed by a quick, small initial bounce and then a prolonged period of very slow growth. A scenario where the economy quickly but only partially bounces back as things begin to re-open and then slowly recovers as the testing and treatment for the virus improves over a longer period of time is one that some economists believe may occur. In fact, Arnab Das, Global Market Strategist for Invesco believes that we may in fact follow this “square root” track.

The fact is, no one can predict the future path of a virus or the economic impact of one. During uncertain times, it is important to “zoom out” and remain committed to your goals and avoid emotional, short-term decision making. Discipline is key and sticking to your financial plan can help you to maintain a long-term perspective as you pursue your goals. Since everyone’s situation is unique, consider speaking to your financial advisor to determine the most appropriate approach for you.

Kurt J. Rossi, MBA, CFP®, CRPC®, AIF® is a CERTIFIED FINANCIAL PLANNERtm & Wealth Advisor. He can be reached for questions at 732-280-7550, kurt.rossi@Independentwm.com, www.bringyourfinancestolife.com & www.Independentwm.com. LPL Financial Member FINRA/SIPC.