The Federal Reserve board recently released the results of financial stress tests on the largest banks in our country. Popularized during the financial crisis, the analysis serves as a means to determine if financial institutions have the financial strength to withstand unfavorable economic scenarios. This year, additional rounds of stress tests were considered due to the continued uncertainty associated with COVID.

The Federal Reserve board recently released the results of financial stress tests on the largest banks in our country. Popularized during the financial crisis, the analysis serves as a means to determine if financial institutions have the financial strength to withstand unfavorable economic scenarios. This year, additional rounds of stress tests were considered due to the continued uncertainty associated with COVID.

The goal of this process is simple – plan for the unexpected before it happens.

Why not apply the same principals to your personal finances? For example, can you still retire on time if the markets experience another major correction of 20 percent or more? Do you have a sufficient financial cushion to handle an unforeseen financial emergency or health related issue?

While planning for the worst and hoping for the best may sound a bit pessimistic, financial stress testing can help identify weak spots in your financial position before an unfavorable scenario happens to you. They say the time to repair the roof is when the sun is shining so consider stress-testing your financial position against the following scenarios.

One important component of the Federal Reserve stress test is to examine the impact of a sudden drop in GDP on bank balance sheets. What if there is a sudden drop in your personal GDP? Perhaps the bonus you rely on has been reduced or a job loss occurs lasting six months. Can you continue to pay your mortgage and protect your credit rating if there is a sudden change in income or expenses? What plans should be considered to address this?

Families or workers who rely on one source of income to cover the majority of their expenses should be especially careful. Stress testing your cash flow for significant declines in income is one of the most critical scenarios to review.

Consider creating a "bare-bones budget" where you identify which expenses can be reduced to cover the bare necessities to live while staying current on any bills and expenses.

Creating a worst-case budget can ensure that you understand which areas of the budget will need to be adjusted to handle a sudden drop in income while helping to prevent unnecessary damage to your financial position.

Portfolio stress test

While complex, portfolio stress testing against various economic scenarios can help investors gauge how their portfolio might react to adverse scenarios before they happen.

For example, how much of a decline could your existing portfolio experience if we were to revisit another financial crisis or a less desirable “W” or “L” shaped recovery?

Establishing an investment plan without an examination of the downside risk can be compared to getting on a roller coaster without seeing how many loops it has beforehand. While stress testing your portfolio will not eliminate the risk of loss or predict an exact outcome, examining the impact of scenarios in advance may help highlight adjustments that need to be made prior to periods of heightened volatility.

From disability and premature death to long-term care expenses, health issues can often have a significant impact on your finances, often derailing long-term goals. This is especially true if others depend on you financially.

For example, can your spouse continue to afford your home and would there be sufficient resources to send your children to college in the event of a premature death? How would a long term care event financially impact a spouse?

Unfortunately, it is not uncommon to overlook this important aspect of planning. Consider running scenarios that highlight the impact of health related issues on the achievement of your financial goals.

Family challenges

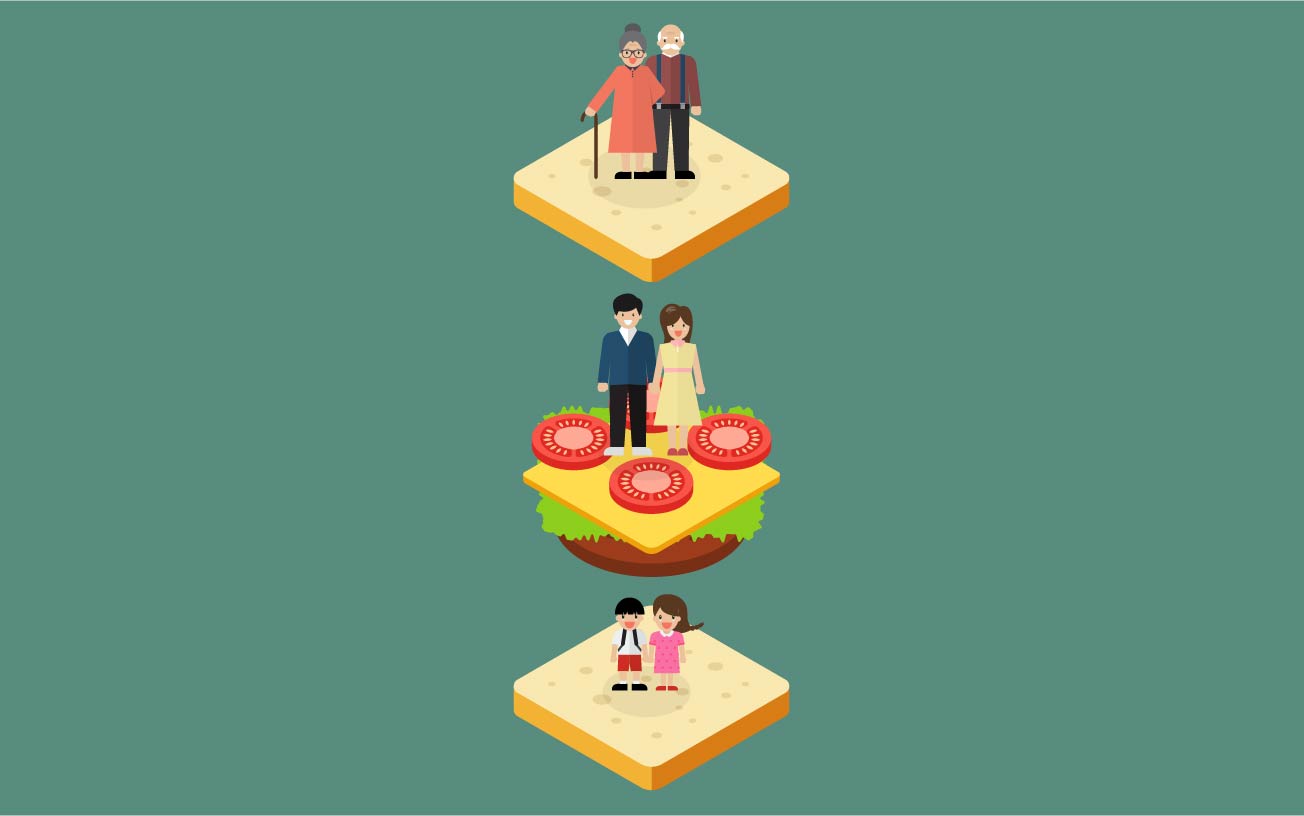

Another financial challenge that can occur may actually come from your own family members. The sandwich generation – those in their 50s or 60s often end up financially supporting aging parents and children simultaneously.

It is not uncommon to see aging parents require financial support because of long term care issues while also having children returning to the nest after college. Do you have parents without long term care insurance? Is there a high probability your children may return home after college? While this may be more difficult to predict, stress testing against unforeseen financial support still warrants attention based upon your individual circumstances.

It might not be possible to insulate yourself from every financial calamity. However, keeping your head in the sand is not advisable. Gaining financial clarity and strategically planning to address issues before they arise can help bring peace of mind, allowing you to focus your time on the things that matter most in life.

Since financial stress testing can be quite complex, consider speaking to your financial adviser to determine the most appropriate approach for you.

Kurt J. Rossi, MBA, CFP®, AIF® is a CERTIFIED FINANCIAL PLANNER & Wealth Advisor. He can be reached for questions at 732-280-7550, kurt.rossi@Independentwm.com, www.bringyourfinancestolife.com & www.Independentwm.com. LPL Financial Member FINRA/SIPC.