According to the U.S Small Business Administration, there are nearly 30.2 million small businesses in the U.S. Unfortunately, only 56 percent offer 401(k) plans and even fewer offer defined benefit pension plans. Business owners are often busy reinvesting capital back into their business and end up being negligent when it comes to thinking about future retirement savings. While adding a 401(k) may be the first step for many, some business owners could also benefit by supercharging their retirement savings – especially if they are behind on their savings goals. What if there was an approach that could allow the business owner to save nearly 10 years’ worth of retirement contributions in one year while still benefiting employees too?

According to the U.S Small Business Administration, there are nearly 30.2 million small businesses in the U.S. Unfortunately, only 56 percent offer 401(k) plans and even fewer offer defined benefit pension plans. Business owners are often busy reinvesting capital back into their business and end up being negligent when it comes to thinking about future retirement savings. While adding a 401(k) may be the first step for many, some business owners could also benefit by supercharging their retirement savings – especially if they are behind on their savings goals. What if there was an approach that could allow the business owner to save nearly 10 years’ worth of retirement contributions in one year while still benefiting employees too?

For high-income business owners that are nearing retirement and have a need to boost their pre-tax savings, the cash balance plan may help. As a result, the popularity of these plans has been steadily increasing.

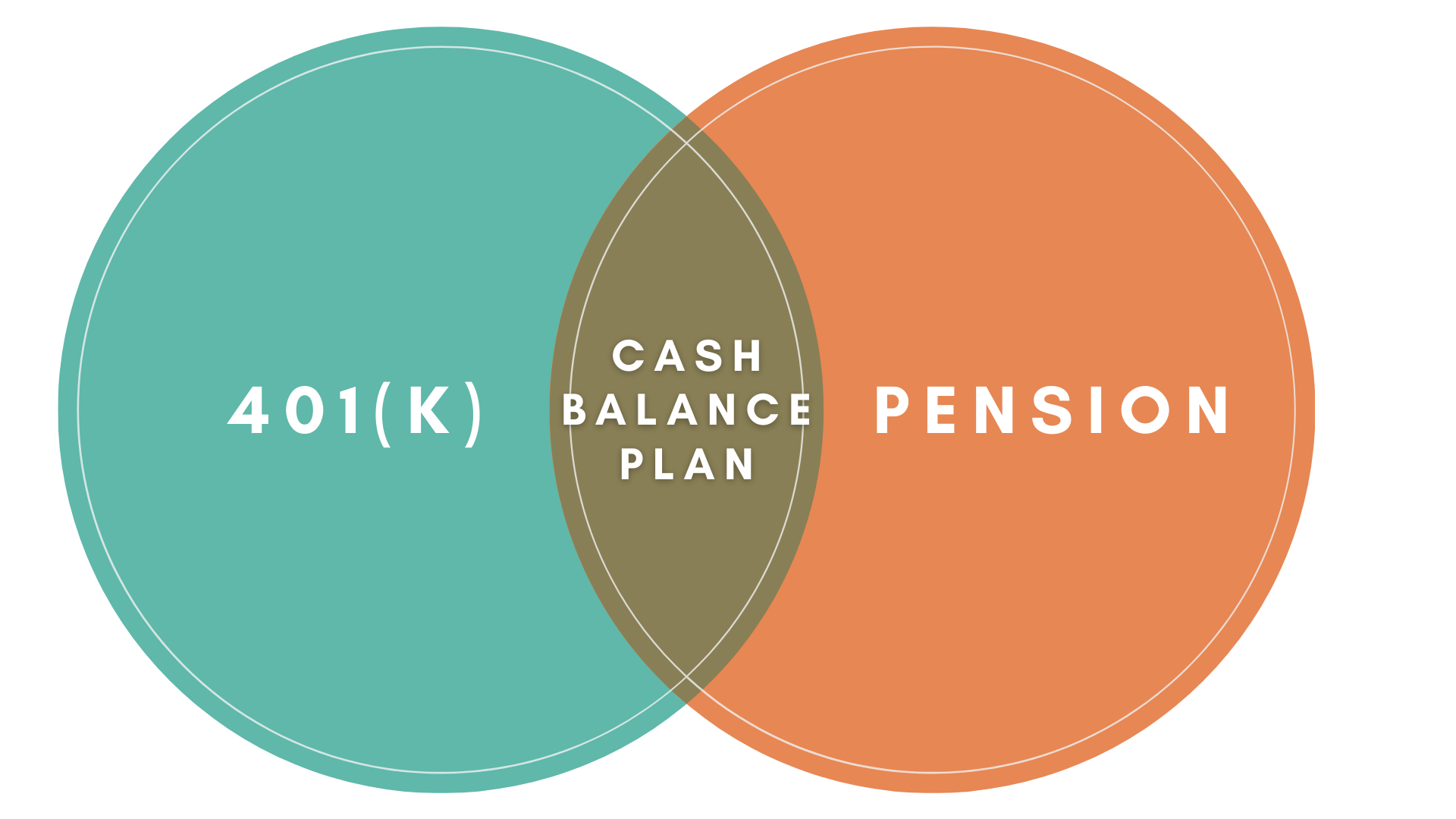

What is a cash balance plan?

So, what exactly is a cash balance plan? A cash balance plan is a cross between a defined contribution plan (401(k)) and a defined benefit plan (pension). These hybrid plans allow for company contributions that are based upon a percentage of pay or a flat dollar amount that receive an annual interest credit to each participant’s balance. While the annual rate credited to each participant is often based upon the 30-year treasury bond yield, the business owner must invest the account in a way to pursue this goal. (The rate credited to participants could be higher or lower than actual returns realized from the underlying investments.) When participants (including the business owner) terminate employment, vested account balances can be withdrawn or rolled over to an IRA or other employer plan for future retirement goals.

Contribution limits

There is a reason the cash balance plan has been described by many as a retirement plan on steroids. Believe it or not, this hybrid plan may allow for pre-tax contributions of up to $266,000 to be made for those age 60, rising to over $276,000 at age 65 – a significantly higher sum then is available in a traditional 401(K) profit sharing plan. (For 2021, 401(k) contribution are limited to $26,000 for those age 50 and older, $19,500 for those under age 50.) While adding a profit-sharing plan will increase the maximum total contribution to $64,500 for those over age 50 ($58,000 under age 50), cash balance plans may allow owners to take pre-tax contributions to another level.

While contributions are skewed toward older participants including the owner, all employees will receive contributions and benefit from the plan. In fact, depending on the calculations, employers may be expected to contribute between 5 percent and 8 percent of employee compensation. Companies can also be selective with who gets the largest contributions. According to Brian Kane, Certified Pension Consultant with Preferred Pension Planning in Bridgewater, NJ, “Cash Balance plans in coordination with a 401(k) may allow companies to be selective in rewarding certain key employees with supersized contributions – especially for those that are older.”

While contributions are skewed toward older participants including the owner, all employees will receive contributions and benefit from the plan. In fact, depending on the calculations, employers may be expected to contribute between 5 percent and 8 percent of employee compensation. Companies can also be selective with who gets the largest contributions. According to Brian Kane, Certified Pension Consultant with Preferred Pension Planning in Bridgewater, NJ, “Cash Balance plans in coordination with a 401(k) may allow companies to be selective in rewarding certain key employees with supersized contributions – especially for those that are older.”

Tax Savings

Since cash balance plans allow for contributions that may be up to 10 times that of a typical 401(k), significant tax deductions may be realized. Oversized tax deductions and on-going tax deferral during a business owners highest earning years can make these plans a powerful financial planning tool.

While there are many advantages, a cash balance plan isn’t right for everyone. Since it is a defined benefit plan, it is not designed to be discretionary. In other words, you are unable to start and stop contributions at will. While cash balance plans can be amended to reduce, freeze or cease contributions, doing so can subject the plan to IRS scrutiny so be careful. Cash balance plans are designed to be a longer-term plan for companies with predictable cash flow that want to save large, tax-advantaged amounts with some regularity.

While there are many advantages, a cash balance plan isn’t right for everyone. Since it is a defined benefit plan, it is not designed to be discretionary. In other words, you are unable to start and stop contributions at will. While cash balance plans can be amended to reduce, freeze or cease contributions, doing so can subject the plan to IRS scrutiny so be careful. Cash balance plans are designed to be a longer-term plan for companies with predictable cash flow that want to save large, tax-advantaged amounts with some regularity.

Entrepreneurs interested in boosting tax deductions and the retirement savings of employees (and themselves) should carefully consider the pros and cons of cash balance plans. Since each company’s situation is unique, consider speaking to your tax and financial advisers to determine the most appropriate plan for you.

Kurt J. Rossi, MBA, CFP®, AIF® is a CERTIFIED FINANCIAL PLANNERtm & Wealth Advisor. He can be reached for questions at 732-280-7550, kurt.rossi@Independentwm.com, www.bringyourfinancestolife.com & www.Independentwm.com. LPL Financial Member FINRA/SIPC

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.