Many hard-working Americans dream of one day reaching financial independence – the time when they are no longer forced to work out of necessity. Unfortunately for many, the realities of trying to stash away enough savings to retire and maintain a comfortable lifestyle is much more difficult than anticipated. A lack of sufficient income, overspending, unexpected health care expenses and poor planning have all contributed toward the retirement challenges that many retirees face.

While the statistics below are surprising, they highlight the importance of developing a sound plan to anticipate and address common challenges faced when preparing for retirement.

How little most Americans have saved

One of the most concerning retirement statistics in America is how little most have earmarked toward this goal. According to the Transamerica Center for Retirement Studies report, total household savings in retirement accounts is $63,000 among workers of all ages and with the average balance increasing to $117,000 for workers in their fifties.

The cumulative shortfall in national retirement savings is even more staggering. The Employee Benefit Research (EBRI) Institute’s Retirement Security Projection Model has estimated that American workers are a nearly $3.83 trillion short of what they need to retire comfortably. Since retirement planning is such a long-term goal, many workers and pre-retirees end up procrastinating rather than taking action to achieve their goals. Time is your greatest resource and the sooner you address your goals, the better. Believe it or not, the 20s can be a great time to start planning for your 60s.

Pushing back the retirement date

Pushing back the retirement date

With less savings set aside for retirement, many pre-retirees are inevitably forced to push back or delay retirement all together. The challenge is that more Americans are delaying retirement than ever before. In fact, in 1991, nearly half of all Americans planned to retire before they reached the age of 65. According the EBRI, 31 percent of workers now expect to retire at age 70 or older.

While working longer can be a part of the solution, many workers incorrectly assume that they will be able to work indefinitely. Unfortunately, other factors such as unexpected health issues or employment availability can force workers into retirement earlier than expected and EBRI statistics highlight this fact. Their survey notes that workers’ median expected retirement age is 65 while the actual median retirement age is 3 years younger - age 62.

Keep in mind, even if you love what you do, working forever may not be feasible. As a result, retirees should consider reviewing multiple financial planning scenarios to assess the impact of retiring at different dates/ages how this will impact your lifestyle. Doing so may help to provide clarity on whether you really do need to push back your retirement date.

Retirees continue to battle debt in retirement

Transitioning into retirement free of any major liabilities is a goal shared by many retirees. However, data from an Experian consumer debt survey notes that the average Baby Boomer has nearly $97,000 in debt. Data also suggests that Boomers owe an average of $178,000 on their home mortgage. Keep in mind, it can be difficult to retire comfortably without having a plan to address outstanding debts so consider a pro-active approach to addressing these liabilities as part of your overall retirement game plan.

Retirement population growing more than you think

The senior citizen population is growing exponentially. According to the U.S. Census Bureau, there are approximately 46 million or about 13 percent of the population over the age of 65. By 2030, it is estimated that the percentage of seniors will jump to 18 percent. By 2050, the number of senior citizens will likely double to almost 90 million. This explosive growth will inevitably place financial stress on the systems that help support our seniors.

Medicare, Medicaid and Social Security may experience significant strain in the future as our retired population continues to grow. Additionally, with people living longer today, outliving savings is more of a concern than ever and is also important to have a plan to address longevity risk.

Assess your Retirement Readiness

Assess your Retirement Readiness

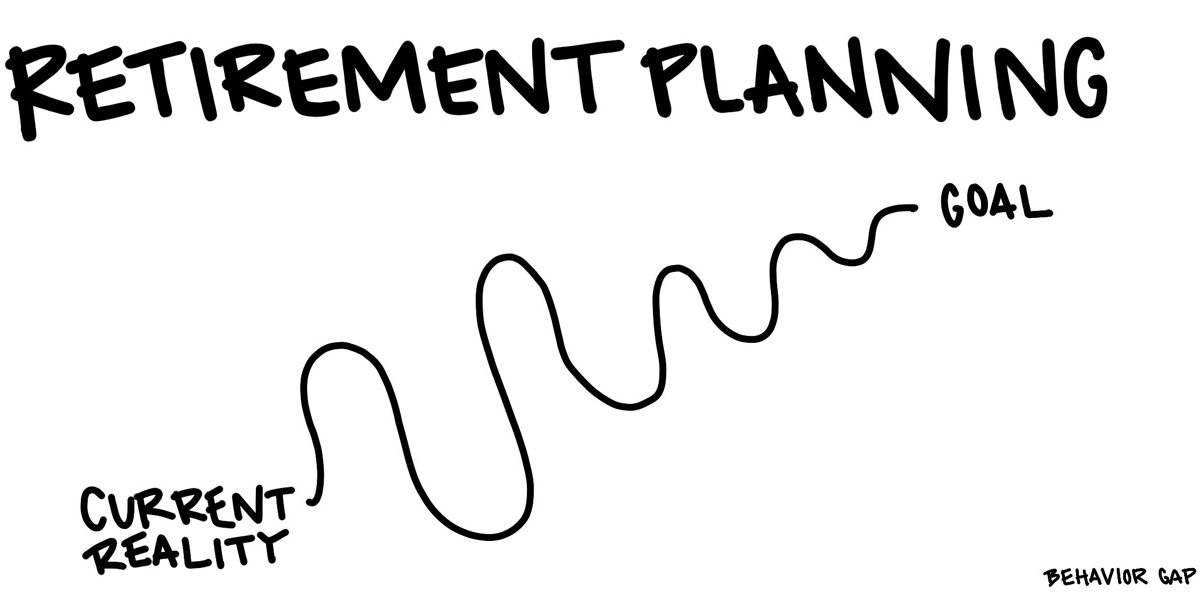

The good news is there is something that can be done about the retirement challenges that many Americans face – plan! While it can be difficult to assess your retirement readiness, developing a holistic financial plan and re-visiting it each year may help improve your retirement trajectory. Consider reviewing your current savings rates, budget, debt levels and portfolio construction to determine whether you are on a sustainable path for your own goals. Retirement planning is complex and since everyone's situation is unique, consider speaking to your financial professional to determine the most appropriate approach for you.

Kurt J. Rossi, MBA, CFP®, AIF® is a CERTIFIED FINANCIAL PLANNERtm Practitioner & Wealth Advisor. He can be reached for questions at 732-280-7550, kurt.rossi@Independentwm.com,www.bringyourfinancestolife.com & www.Independentwm.com. LPL Financial Member FINRA/SIPC.