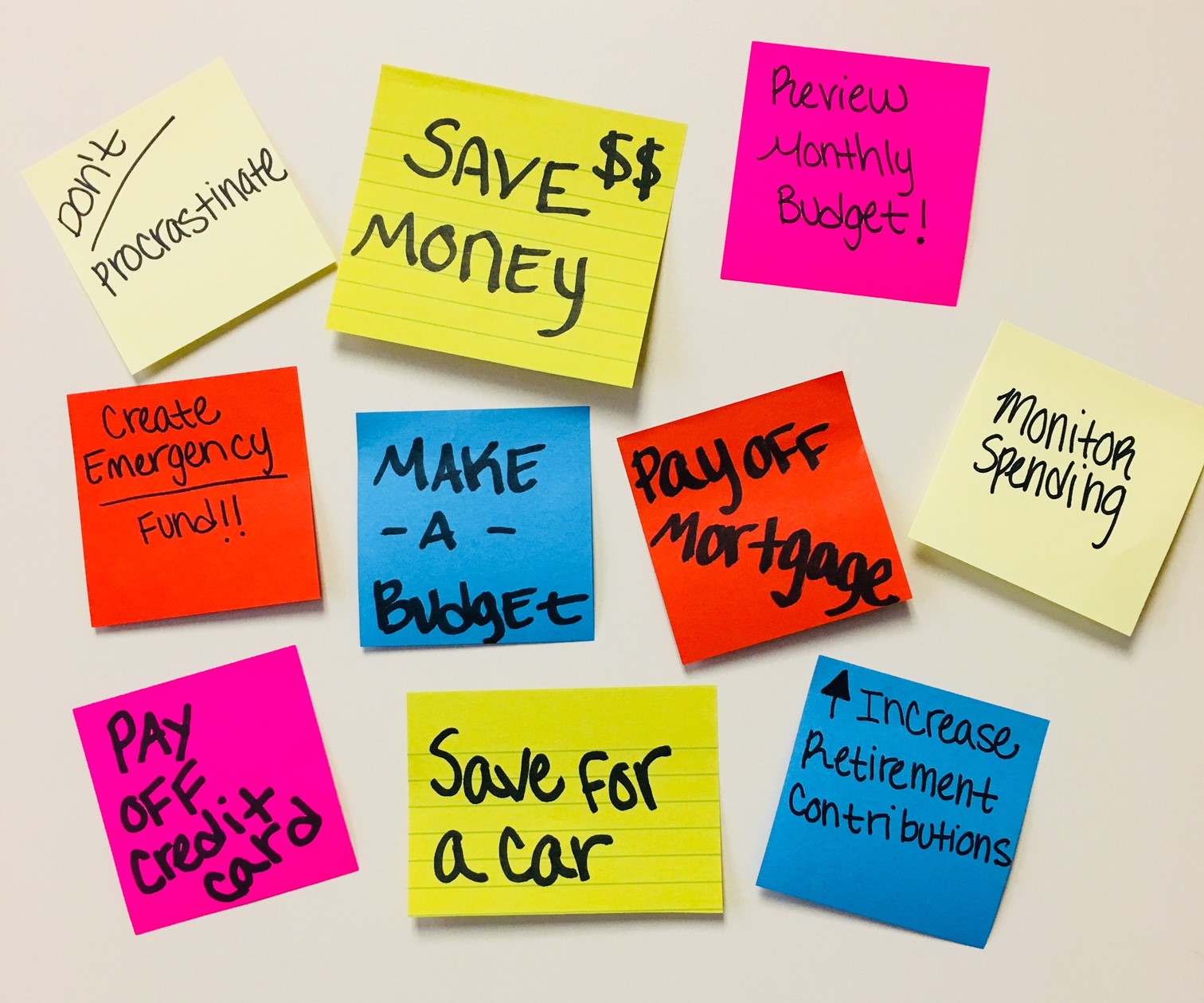

Next to health and wellness, financial resolutions are usually the next most common goal for the New Year. According to the Fidelity Investments 2022 New Year’s Financial Resolutions Study, the top 3 financial resolutions for 2022, as given by those surveyed, are to save more money (43%); pay down debt (41%); and spend less money (31%). The survey also noted that 62% of Americans feel optimistic about the future. Remember, developing a financial plan early in the year can be a great way to help you pursue the goals that are most important to you. Rather than take a general approach, consider reviewing following specific goals for 2022.

Next to health and wellness, financial resolutions are usually the next most common goal for the New Year. According to the Fidelity Investments 2022 New Year’s Financial Resolutions Study, the top 3 financial resolutions for 2022, as given by those surveyed, are to save more money (43%); pay down debt (41%); and spend less money (31%). The survey also noted that 62% of Americans feel optimistic about the future. Remember, developing a financial plan early in the year can be a great way to help you pursue the goals that are most important to you. Rather than take a general approach, consider reviewing following specific goals for 2022.

Improve your financial awareness

Do you know approximately how much you are spending each month and have you completed an updated budget? What percentage of your income are you saving? How much are you paying toward debt and what are you being charged in interest costs? Unfortunately, many people are simply unaware of where they stand financially. Begin the New Year by accounting for all of your assets, liabilities and expenses. Consider building a budget, reviewing life and disability insurance and requesting an updated credit report. Remember, before developing a plan for where you want to be, it is important to have an awareness of where you currently are.

2021 was a difficult year for many bond investments and 2022 may not be much better. That is because bond values generally have an inverse relationship to interest rates. Since the yield on the 10-year government bond has been increasing, some bond investments have been facing headwinds.

While certain bonds have struggled, it doesn't necessarily mean that investors should be piling into equities. Remember, stocks are not a substitute for bonds or cash and investors need to carefully review their tolerance for risk. However, there are strategies that may help to reduce the sensitivity of your bond portfolio to interest-rate increases.

One strategy that you may want to consider is reducing the duration of your bond portfolio. Consider reviewing your portfolio on www.Morningstar.com or working with a professional to determine the duration of your current holdings. Duration measures the sensitivity of your bond portfolio to changes in interest rates and doing so may help confirm that you are properly allocated based upon your specific goals.

Adjust Retirement Contributions to the New Limits

Adjust Retirement Contributions to the New Limits

The new year is a great time to review your current retirement plan contributions and with the IRS increasing limits for 2022, it more important than ever to consider boosting your savings. Participants can now contribute up to $20,500 for 2022 and savers over the age of 50 can contribute an additional $6,500 for a total of $27,000. For small business owners, the total contribution limits for retirement plans including profit sharing is now $61,000. (The same over age 50 catch-up provision of $6,500 applies to business owners too.) Additionally, for high-income earning business owners, contribution limits to a Cash Balance Plan have jumped to $245,000 in 2022.

Consider a Roth 401(k)

Roth 401(k) plans are becoming more common within company-sponsored plans. While you will not receive a tax deduction for contributions made to a Roth 401(k), the earnings may grow tax-free when implemented according to IRS rules. That’s right, tax-free. If you believe you will be in the same or higher tax bracket at retirement, a Roth 401(k) may be an appropriate fit.

Unlike the Roth IRA, Roth 401(k)s have no maximum income threshold for participation – even high- income earners can take advantage. Additionally, Roth 401(k) balances may be rolled over to a Roth IRA at retirement, eliminating the requirement to take RMDs (required minimum distributions) at age 72.

A Roth 401(k) isn’t appropriate for everyone but it can be a powerful tool. Taxpayers who believe they will be in the same or lower tax bracket at retirement may benefit from taking the tax deduction today by sticking with a pre-tax 401(k) so be sure to speak to your accountant to determine which is better for you.

Re-assess your recurring bills

Re-assess your recurring bills

From streaming services to mobile apps, consumers are spending (and sometimes wasting) more money on subscription services and recurring bills then ever before. And since so many of us automate bill pay, it is easy to forget what services we are paying for. In fact, a survey by West Monroe noted that 89% of consumers underestimated what they spent on subscription services each month. Consider reviewing your monthly expenses and identifying any services or subscriptions you are paying for that you do not use. This can be a great way to eliminate financial waste.

After reviewing subscriptions, consider moving on to evaluate other costs such as homeowners insurance, auto insurance and any other expenses on your budget to see how you might be able to reduce unnecessary spending.

Developing financial resolutions based upon your unique goals can be a powerful exercise. Remember, a clearly defined plan may help you work toward the pursuit of your goals. Since everyone’s circumstances are unique, consider speaking to your tax, legal and financial adviser to determine the most appropriate approach for you.

Kurt J. Rossi, MBA, CFP®, AIF® is a CERTIFIED FINANCIAL PLANNER & Wealth Advisor. He can be reached for questions at 732-280-7550, kurt.rossi@Independentwm.com, www.bringyourfinancestolife.com & www.Independentwm.com. LPL Financial Member FINRA/SIPC.