Are you “retirement-ready”? Many people dream of a retirement filled with time spent traveling, enjoying hobbies and making lasting memories with family. However, it is not always easy to know when it is the “right time” to stop working. After dealing with elevated levels of inflation and continued economic uncertainty, it may be common for pre-retirees to question their readiness to retire and in some cases, unexpectedly postpone their retirement dreams.

According to the Employee Benefits Research Institute (EBRI), the share of workers planning to delay retirement rose to 33 percent in 2023 from 29 percent in 2022 and 26 percent in 2021. Overall, a surprising one third of workers expect to delay retirement until after age 70. The misconceptions noted below highlight a few of the inaccurate assumptions that have forced some retirees to adjust their plans.

I will spend less after retirement.

People often assume that retirees will need 70 to 80 percent of what they currently spend during retirement. While some savings will be realized from a lack of commuting costs and the possible downsizing of a home, the reality is that retirement expenses for some retirees are often 90 to 100 percent of their expenses before retirement. This is partially due to the desire to spend more time on hobbies and traveling during the early years of retirement when many retirees are at their healthiest. In addition, health care costs can also take a huge unexpected bite out of the budget, further increasing expenses and preventing retirees from realizing a substantial reduction in spending.

Basic Medicare will cover all my health care expenses.

Basic Medicare will cover all my health care expenses.

According to Fidelity Workplace Consulting, the average 65-year-old couple can expect to spend an average of $314,000 on health and medical costs over a roughly 20-year retirement, not including long-term-care costs. The complexities of insurance coverage have made it difficult for many savers to accurately estimate their effect on expenses after retirement. In addition, many retirees inaccurately assume that basic Medicare will cover the majority of their needs.

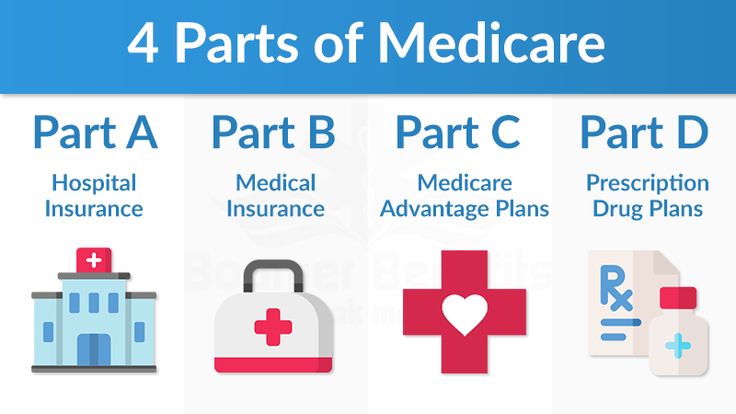

Medicare Part A covers hospital benefits and is usually provided at no additional cost. However, the outpatient services provided by Medicare Part B and the prescription-drug coverage offered by Medicare Part D have additional charges associated with them. Also, remember that it is often necessary for retirees to choose a private Medigap policy that can help cover the costs that Medicare doesn’t cover. As a result, many retirees end up spending significantly more than they had planned on health care expenses and should be careful to budget for these expenses to increase over time.

Additionally, assisted living and/or long-term care costs should be considered. Do you currently have a conventional long-term care or hybrid long-term care policy to cover a portion of these expenses? If not, it is important to have realistic assumptions about out-of-pocket expenses and the potential impact on the spouse or children.

Social Security benefits are federally tax-free.

Social Security benefits may be taxable if you file a federal tax return as an individual and your total income is more than $25,000. If you file a joint return, your benefit may be taxable if you and your spouse have a total income of more than $32,000.

Generally, 50 percent of your Social Security benefit will be taxable if your income exceeds the thresholds. However, when income exceeds $34,000 for single taxpayers and $44,000 for joint filers, up to 85 percent of your benefit could be taxable.

In addition, Social Security benefits are reduced $1 for every $2 you earn over $21,240 if you haven’t reached your normal retirement age yet. In the year you reach normal retirement age, your benefit will be reduced $1 for every $3 for the months leading up to your normal retirement age. For more information, consider speaking to your tax adviser and visiting www.ssa.gov.

Social Security will always keep up with inflation.

Social Security will always keep up with inflation.

According to the Social Security Administration, the purpose of the cost-of-living adjustment is to ensure that the purchasing power of Social Security benefits is not eroded by inflation. However, many seniors have realized that Social Security does not always reflect the inflation they experience. While the cost-of-living adjustment (COLA) for 2022 was 8.7 percent, many economists are forecasting a much smaller increase next year and there have been years in the past where no inflation increase occurred. Remember, seniors often spend a disproportionate amount of their income on health care, food and travel expenses which may not be weighted in the same way as the calculation of CPI-W which is used by the Social Security Administration to calculate their COLA.

In addition, some politicians have discussed changing how the cost-of-living adjustment will be calculated for future years so that retirees experience lower inflation adjustments in an effort to reduce the financial burden on the system. Stay tuned to see what adjustments, if any, are made to how inflation is calculated.

I will be in a lower tax bracket at retirement.

I will be in a lower tax bracket at retirement.

While people who rely solely on Social Security as their primary income may find themselves in a lower tax bracket, retirees with supplemental income sources may experience something very different. Remember, withdrawals from 401(k)s, traditional IRAs, and other qualified accounts may be taxable as ordinary income. Additionally, some retirees have other income sources such as rental properties or small businesses. Factor in any additional pension income, and you are suddenly in a tax bracket that is not unlike the bracket you were in when you were working. As a result, it is important to have realistic expectations about your tax liabilities in retirement while making adjustments for how these liabilities might change should you move to another state or downsize your home. Either way, be sure not to underestimate your tax liability in retirement.

Rather than make decisions with incomplete information, consider developing a holistic, comprehensive financial game plan that may help provide clarity and eliminate some of the inaccurate assumptions about retirement. Doing so may allow for more time to be spent on what retirement means to you. Since everyone’s situation is unique, consider speaking to your financial adviser to determine whether a downsize may be a good fit for your situation.

Kurt J. Rossi, MBA, CFP®, AIF® is a CERTIFIED FINANCIAL PLANNERtm & Wealth Advisor. He can be reached for questions at 732-280-7550, kurt.rossi@Independentwm.com, www.bringyourfinancestolife.com & www.Independentwm.com. LPL Financial Member FINRA/SIPC.