-

New Roth conversion strategy may help retirees minimize taxes

Taking advantage of pre-tax retirement savings within a 401(k) or similar account is a great way to reduce your current taxable income while socking away funds for the future. With ... -

How do your company benefits stack up?

As the unemployment rate continues to fall, wages are beginning to rise and for the first time in years, many companies are improving their benefits plan offerings.In fact, according to ... -

5 financial rules of thumb to consider breaking

Wouldn't it be nice if financial planning was simple and the same financial strategies were applicable to most everyone? Unfortunately, there are no cookie-cutter approaches to financial management. From investment ... -

5 shocking retirement statistics

Many hard-working Americans dream of one day reaching financial independence – the time when they are no longer forced to work out of necessity. Unfortunately for many, the realities of ... -

Despite improving job market, challenges still lie ahead for Class of 2015

A new batch of graduates will soon begin the difficult transition from college student to becoming self-sufficient. From securing employment that pays well enough to address student loan debt to ... -

Parents should be wary of endangering retirement to support 'Emerging Adults'

Each year, an increased number of baby boomers end up financially supporting their adult children in some way - often to the detriment of their own financial goals. Recent data ... -

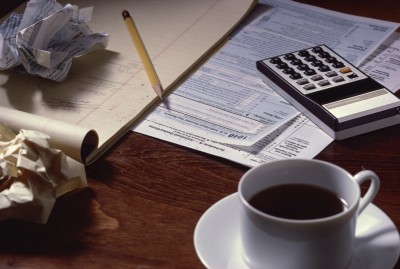

5 commonly missed tax breaks that can save you money

It is that time of year again: Tax time. W2s, 1099s and other assorted tax documents have begun to pile up as Americans prepare to file their returns in the ... -

Smart money moves for 2015

The new year is often used as a time to reflect and establish goals for 2015. From health and wellness to financial and family goals, there are many areas to ... -

Small Social Security increase for 2015 highlights need to have a plan B

The federal government recently announced that Social Security payments will increase in 2015 for the nearly 60 million Americans receiving benefits. The bad news is that the 1.7 percent cost ... -

Now is the time for year-end tax planning

The ideal time to address 2014 tax planning is in – you guessed it – 2014. Unfortunately, many taxpayers wait until the tax preparation months of March and April of ...