-

6 Retirement roadblocks that could disrupt your plans

The definition of retirement is evolving. Advances in technology and healthcare have contributed toward longer life spans and in turn, a change in retiree habits. From working longer to living ... -

5 Smart ways to invest your tax return

The Internal Revenue Service expects more than 153 million tax returns to be filled this year with nearly 111 million taxpayers receiving a refund. That’s right – over 70 percent ... -

Overlooked Tax Breaks You Can't Afford To Miss

Each year, Americans continue to overlook tax breaks that may have put money back in their pocket. While many taxpayers would prefer to pay the IRS as little as possible, ... -

Smart money moves for 2017

As 2016 comes to a close, it is a good time to reflect on the past while embracing the opportunity of the New Year ahead. For those making resolutions, finances ... -

Overcoming the 3 Biggest Financial Regrets

Life is filled with an overwhelming number of financial choices. Like many decisions in life, there are certainly some financial matters we might have handled differently. In fact, financial regret ... -

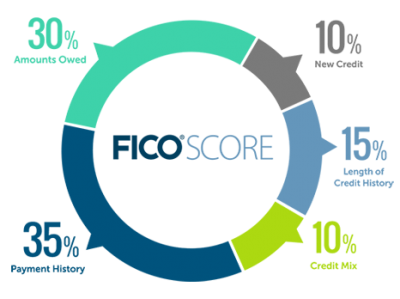

10 Steps To Boost Your Credit Score

Americans continue to rely on debt to finance many of their consumer purchases. In fact, according to the Federal Reserve, total U.S. outstanding consumer debt is nearly $3.62 trillion. Because ... -

How to Retire in a State on the "Worst States To Retire In" List

We have all seen the lists of states to avoid when retiring. Elevated income tax and property rates, higher costs of living and excessive estate and inheritance tax rates are ... -

Money moves to make at every age – 50s & beyond

Money moves to make at every age – 50s & beyond This is the second of a two-part series on the financial moves that should be considered at various pivotal ... -

Money moves to make at every age – part 1

Life is a journey filled with financial choices that ultimately shape your future. While money may be important to many, it is simply a tool to help people focus on ... -

Surprising Facts About The Financial Health Of Americans And What You Can Learn From It

The financial health of many Americans is more surprising than you may think. While personal finances in this country have improved in the last few years, the recently released Federal ...